It’s almost unfathomable that in just two months, there were 100,000 small businesses who needed to close their doors for public safety. As a result of this, many of those businesses closed for good! With these mass closures, the local real estate market is suffering, especially considering that 18 million people have lost their jobs and are having difficult time making ends meet.

Despite the economic downturn, the 81% of real estate agents that participated in the Homelight Q4 2020 survey are anticipating their market is going to be improving. They’ve even taken measures to adapt to the new challenges the pandemic has presented them! But, perhaps the real question is whether or not the market in communities where a lot of small businesses have closed will improve.

To get a better understanding of how business closures affect residential real estate, let’s take a look at some of the highlights from the survey.

Business closures are a turnoff for buyers

When buyers and renters are looking for a place to live, they look at many factors: job opportunities, school districts, recreational activities and crime rate to name a few examples. In those communities where businesses have closed, there’s going to be fewer job opportunities. In areas where jobs are scarce, so will the interest to move there. That means everything is going to decline even further. For example, with fewer people living in an area, the school systems will lose funding. Crime rates are likely to increase.

It isn’t just small communities that are experiencing the loss that comes with business closures. San Francisco’s financial district has become a “ghost town.” New York City lost a lot of jobs because there have been over 500,000 restaurant closures! We all know one of the things that makes NYC so popular is their massively diverse cuisine offerings.

There’s a steep decline in rental and home prices

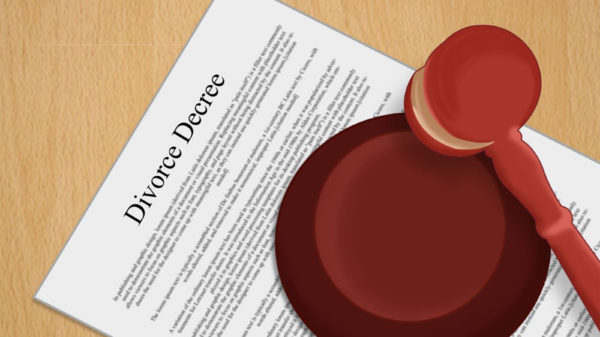

Sellers and landlords are becoming desperate and they’re dropping their prices just to get some activity. Landlords need to lower rental prices because the longer their rental properties stay vacant, the further into debt they go. Homeowners that need to sell are dropping prices because they need to move and they cannot pay two mortgages. It’s tough right now because some are likely to lose a significant amount of money just because people aren’t interested in living in a community with nothing to it.

Homelessness looms in hurting communities

As businesses continue to cut hours or close down for good, the number of unemployment claims are skyrocketing. People who have lost their jobs in communities where work is scarce are unable to pay bills, fall behind in payments, and feel hopeless. About 20% of surveyed real estate agents worry that once the mortgage forbearance and eviction moratoriums end on March 31st, they are going to see a surge in homelessness.

When there are mass business closures, there are going to be a huge drop in job opportunities. When people cannot find work, they’re not going to be able to pay their bills. When they can’t pay their bills, either they will try to relocate to a new community where there are job opportunities. That’s understandable, right? Of course it is, no one wants to go into debt, ruin their credit, and possibly lose everything – especially when it wasn’t their fault they are in the current situation.

Although it can feel like the world is against you and it’s trying to keep you down, please remember that the current situation isn’t permanent. Businesses will reopen. Families will find work. Life will gain some kind of normalcy. All we can really do is look forward to tomorrow and trust that things will improve.