In today’s era Blockchain is a disrupting and swiftly rising generation this is designed for constructing inter-organizational, assigned, and reorganized systems for managing assets, physical assets, and facts. Moreover, it is a decentralized technology that uses cryptography to secure transactions while not having to depend upon a government or a trusted organization. In other words, its miles a generation that has the capability to create huge social and financial change on a global scale.

What you should learn in blockchain programming

- You may benefit primary blockchain programming skills and an understanding of strengths, trade-offs, risks and legal factors of blockchain systems. extra specifically, after this course you will be capable of:

- provide an explanation for the essential building blocks of blockchain/DLT structures and the architectures of existing popular blockchain/DLT systems

- understand inherent trade-offs preventing the improvement of a single blockchain gadget this is first-class for all makes use of

- become aware of risks of and assaults on smart contracts in popular blockchain/DLT structures

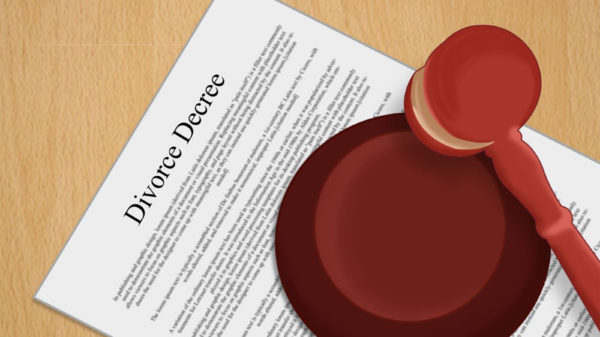

- compare contractual and regulatory factors of putting in and operating a blockchain-based totally venture with clever contracts

Perform institution-based smart contract programming in Ethereum (the maximum extensively used public blockchain systems) on distilled, consultant problems, which include the issuance of new cryptocurrencies (tokens, coins), crowdfunding (initial coin offerings), economic contracts and useful resource monitoring.Currently, there are three types of blockchain networks – public blockchains, private blockchains and consortium blockchains.

Recommended Reading : Pay Point India

With conventional transactions, a payment from one individual to another includes a few sort of intermediary to facilitate the transaction. Let’s say Bob needs to transmit$20 to Merina. He can both supply her coins in the shape of a $20 word, or he can use some sort of banking app to transfer the money at once to her financial institution account. In each instances, a financial institution is the intermediary verifying the transaction: Bob’s finances are demonstrated whilst he’s taking the cash out of a cash machine, or they’re tested by way of the app when he makes the virtual switch. The bank decides if the transactions need to go in advance. The bank additionally holds the file of all transactions made by way of Bob, and is only accountable for updating it whenever Rob pays someone or receives money into his account. In different phrases, the bank holds and controls the ledger, and everything flows through the bank. This is how blockchain works.

You must be logged in to post a comment Login