All first-time landlords face a variety of obstacles and inevitable mistakes. Although renting out properties can be stressful for the inexperienced, it will quickly become an outstanding source of income if done correctly. To become a successful landlord, it’s necessary for you to constantly learn and adapt to new rental practices. With that in mind, here are some tips to help first-time landlords avoid common (and often costly) mistakes.

Screen your renters

The primary goal of each landlord is finding a responsible tenant to rent your property. Failing to screen potential tenants can lead to costly, time-consuming evictions and late rent payments. Companies offer free property management software to assist landlords with screening tenants and managing rental properties.

To find reliable renters, start the screening process with a rental application. A face-to-face conversation with interested renters will help you get to know them even better. Make sure to ask questions about their income, employment, and inquire into the reason why they’re moving. In addition, ask for past and current landlords, employment, and personal references.

Screening tenants through questioning and references is a great place to start, but it’s also necessary to run a criminal background, eviction history, and credit report check. These reports will highlight any red flags and give you more information regarding your potential tenants’ financial history. Since it’s crucial to avoid accusations of discrimination, set a minimum credit score and use the same criteria for each applicant.

Know the laws

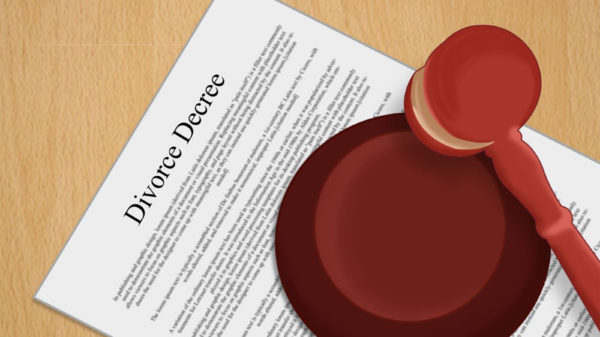

If you’ve never rented before or you’re renting in a new location, you should take the time to research your federal and local Fair Housing Laws. Fair Housing Laws prohibit housing discrimination against protected classes, which vary by state and city.As previously mentioned, it’s important to avoid accusations of discrimination and Fair Housing violations. You should be able to justify each decision to reject a rental application on sound business grounds. For example, it’s legal to reject applicants because they don’t meet your minimum criteria for credit history, but it’s discriminatory to reject applicants because of their ethnicity. Basically, consistency in your decision-making is vital to avoid liability.

Knowing your local and federal housing laws will keep you out of legal trouble and save you legal fees. If you have any questions, don’t hesitate to meet with a local attorney who specializes in landlord-tenant laws. It’s important to remember that having a provision written into your lease doesn’t necessarily mean it’s a binding legal agreement or it will hold up in court.

Put everything in writing

Keeping either a digital or handwritten paper trail will help you stay organized and deal with potential tenant issues in the long-term. If you do your bookkeeping digitally, make sure it’s backed up somewhere. If it’s handwritten, keep it in a safe space where it won’t get lost or thrown away. You should be keeping a detailed archive of vendors you pay, rent collected, and any materials purchased to maintain the home.

Effective and organized bookkeeping will have a huge payoff during tax season. You’ll be able to easily organize your expenses and the documents you’re going to need to file, which is necessary whether you’re doing taxes yourself or enlisting the help of an accountant.

Becoming a landlord comes with a multitude of obstacles and lessons to be learned. To avoid making easily avoidable mistakes, it’s crucial to do your research on housing laws within your jurisdiction, screen tenants, and keep your bookkeeping in order. Although you’ll face initial challenges, you’ll be profiting off of your rental properties in no time.

You must be logged in to post a comment Login